The City of Vancouver has introduced a Vacant Home Tax to increase rentals in the City of Vancouver.

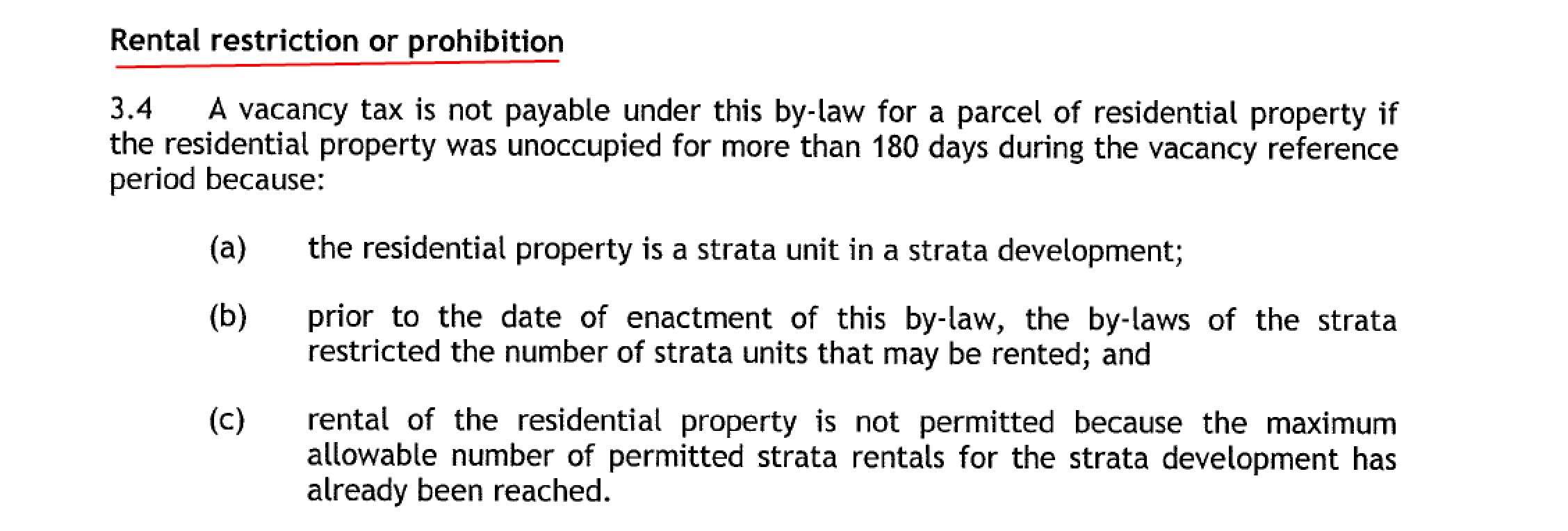

How does this new tax affect those who live in strata buildings with rental restrictions? If your strata prohibits the number of rentals prior to the date of the introduction of the tax and your strata has no availability to rent your suite, you will not be taxed. The Provincial Strata Property Act governs strata buildings. The Strata Property Act allows buildings to change bylaws with a 3/4 vote of the owners. The new City of Vancouver Vacancy tax will circumvent the Strata Property Act as rental restrictions put in place after the introduction of the tax will BE SUBJECT to the tax.

This new tax has also banned the concept of a pied-à-terre. For example: you live full time in Kamloops with a condo in downtown Vancouver. You come to Vancouver sporadically for business and pleasure. If you use your condo as you need it, you will be taxed if you do not come to Vancouver often enough to satisfy the requirements below.

Who won’t be subject to the tax

Most Vancouver homeowners, including snowbirds, will not be subject to the Empty Homes Tax. Principal residences will not be charged the Empty Homes Tax, nor will properties that are rented long-term (with a tenancy agreement), or for at least 30 days in a row for a minimum of six months in aggregate over the course of a year. For example, a homeowner renting their investment property for six 30-day terms throughout the year will be exempt from the tax, even if those six 30-day terms are not consecutive.

How the tax was determined

The 1% Empty Homes Tax rate was determined through consultation with industry experts and the public. Applying a 1% tax in addition to existing property tax aligns with current business property taxes, reinforcing the principle that housing used as a business will be taxed as such – particularly as Vancouver grapples with a housing affordability crisis.

Tax exemptions

Through public and stakeholder consultation, staff have confirmed exemptions for the Empty Homes Tax, including:

- The property is undergoing major renovations, or is under construction or redevelopment (with permits).

- The registered owner (or other occupier) is undergoing medical or supportive care.

- The owner is deceased and grant of probate or administration is pending.

- Ownership of the property changed during the previous year.

- The property is subject to existing strata rental restrictions.

- The registered owner uses the property for six months of the year for work purposes but claims principal residence elsewhere.

- The property is under a court order prohibiting occupancy.

- The property is limited to vehicle parking or the size, shape or inherent limitation such that a residential building cannot be constructed.

You must be logged in to post a comment.